sales tax calculator tulsa ok

As far as other cities towns and locations go the place. Tulsa has parts of it located within Creek.

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Maximum Possible Sales Tax.

. For a first modification amendment or extension of a prior mortgage click on the first modification link. This includes the sales tax rates on the state county city and special levels. Sales tax in Tulsa Oklahoma is currently 852.

Tulsa County - 0367. This is the total of state and county sales tax rates. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does.

The latest sales tax rate for New Tulsa OK. This rate includes any state county city and local sales taxes. Mortgage Tax Calculator.

How much is sales tax in Tulsa in Oklahoma. The average cumulative sales tax rate between all of them is 828. Some cities and local governments in Tulsa County collect.

Avalara Will Calculate Tax and File Your Returns in 24 States for Free. 4732 S 87th Ave Tulsa OK 74145 190000 MLS 2217804 This updated cute 322 sits in a lovely park-like setting with. Oklahoma has a 45 statewide sales tax rate but.

2483 lower than the maximum sales tax in OK. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Ad Having to Collect and Remit Sales Tax in More States Now That Remote Sales Are Taxable. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

3 beds 2 baths 1318 sq. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

Rates include state county and city taxes. Maximum Local Sales Tax. The December 2020 total local sales tax rate was also 4867.

Oklahoma State Sales Tax. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tulsa OK. Avalara Will Calculate Tax and File Your Returns in 24 States for Free.

The most populous location in Tulsa County Oklahoma is Tulsa. Tulsa County Sales Tax Rates for 2022. State of Oklahoma - 45.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Use this calculator for Tulsa County properties. Average Local State Sales Tax.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. 2020 rates included for use while preparing your income tax deduction. The current total local sales tax rate in Tulsa OK is 8517.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The latest sales tax rates for cities in Oklahoma OK state. The current total local sales tax rate in Tulsa County OK is 4867.

You can find more tax rates and. 7853 E Jasper St Tulsa OK 74115-6919 is a single-family home listed for-sale at 139000. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. See If You Qualify.

The base state sales tax rate in Oklahoma is 45. See If You Qualify. 2020 rates included for use while preparing your income tax deduction.

The average cumulative sales tax rate in Tulsa Oklahoma is 831. Find your Oklahoma combined. The December 2020 total local sales tax rate was also 8517.

The sales tax rate for Tulsa was updated for the 2020 tax year this is the current sales tax rate. The Tulsa County Oklahoma sales tax is 487 consisting of. Ad Having to Collect and Remit Sales Tax in More States Now That Remote Sales Are Taxable.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. The Oklahoma state sales tax rate is currently.

How To Calculate Sales Tax Video Lesson Transcript Study Com

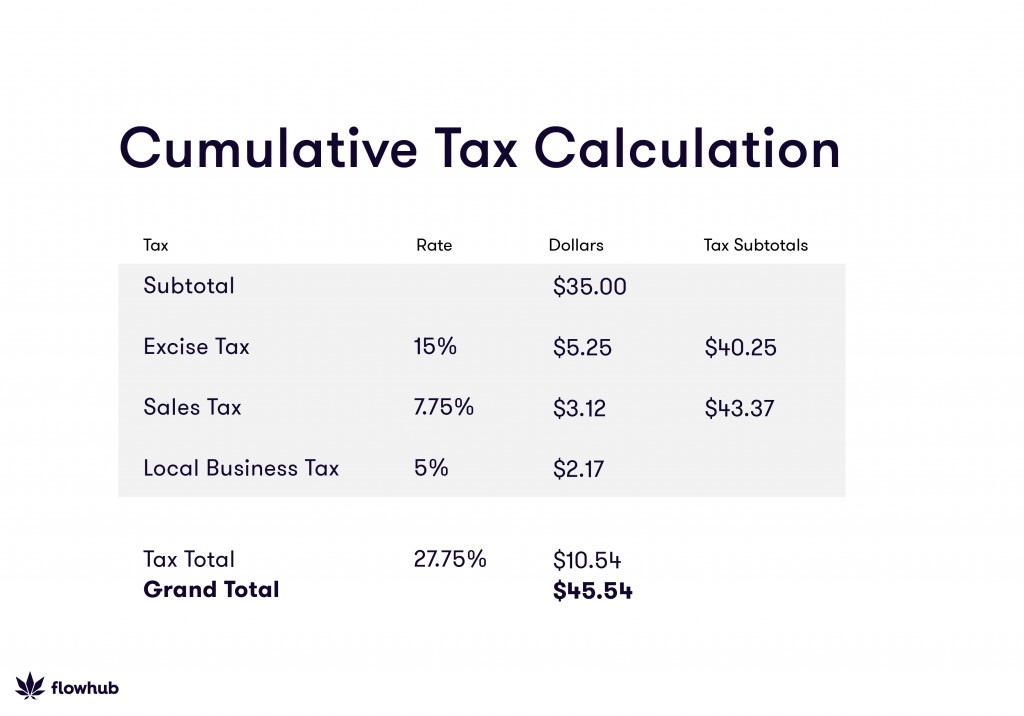

How To Calculate Cannabis Taxes At Your Dispensary

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

When Are Taxes Due In 2022 Forbes Advisor

Oklahoma Sales Tax Small Business Guide Truic

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Oklahoma State Tax Ok Income Tax Calculator Community Tax

How To Calculate Sales Tax On Calculator Easy Way Youtube

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Cannabis Taxes At Your Dispensary

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

How To Calculate Sales Tax Definition Formula Example

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Oklahoma State Tax Ok Income Tax Calculator Community Tax

Oklahoma State Tax Ok Income Tax Calculator Community Tax

How To Calculate Sales Tax Definition Formula Example