straight life policy formula

Determine the useful life of the asset. If the dividends accumulate interest the interest amount is considered taxable income just like other accounts that accrue interest.

Nonlinear Equation Graphs Basic Example Video Khan Academy

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums.

. The formula for the straight-line depreciation method is quite straightforward to calculate. Typically you buy one and make regular payments during your working life or pay a single lump sum usually after retirement. Upon death the payments stop and you cannot designate a beneficiary with this type of insurance.

Acquisition cost Salvage value Service life years. The amount determined in accordance with the benefit formula selected in Part 4 of the Agreement. Cost - Residual Value Useful Life.

Ing life table and interest rate are chosen provisionally company employees without quantitative training could calculate premiums in a spreadsheet for-mat with the aid of a life table. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. Journal Entries for Straight Line Method of Depreciation.

Book value of fixed assets is the original cost of fixed assets including. Insurance on the life of the insured for a fixed amount at a definite premium that is paid each year in. Formula The annual depreciation rate under the straight-line method equals 1 divided by the useful life in years.

Annual depreciation purchase price - salvage value useful life. Looking for information on Straight Life Policy. Quiambao Lance Trestan C.

System Has Immediately Commencing Straight Life Annuity Payable at Both Age Sixty-five 65 and Age of Commencement. This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset cost to get total depreciation then divide that by useful life to get annual depreciation.

The rate of Depreciation Annual Depreciation x 100 Cost of Asset. Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. Purchase price and other costs that are necessary to bring assets to be ready to use.

View Straight Line Formula - Mas Grouppptx from CEGE CE40 at Mapúa Institute of Technology. The depreciation amount is the same every year. Straight Line Formula Mas III Samuel M.

Like all annuities one may buy the plan with a lump sum or with a series of payments over a number of years usually ending. The company uses depreciation for physical fixed assets and amortization for intangible assets. In the straight-line method depreciation expense for a period is calculated by multiplying the depreciable amount the difference between cost and residualsalvage value with the annual depreciation rate and a time factor.

The straight line calculation steps are. Click to go to the 1 insurance dictionary on the web. A straight life insurance policy can also build cash value over time.

To fix the idea consider first the contract with the simplest net-single-premium formula namely the pure n-year endowment. Amount of Depreciation Cost of Asset Net Residual Value Useful Life. The useful life of the assethow many years you think it will last.

Straight-line Method Formula Depreciation Expense Cost Salvage ValueUseful life Cost. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax. Divide the sum of step 2 by the number arrived at in step 3 to get the annual depreciation amount.

Both depreciation and amortization apply the same concept. System Does Not Have Immediately Commencing Straight Life Annuity Payable at Both Age Sixty-five 65 and the Age of Benefit Commencement. Straight line depreciation can be calculated using the following formula.

Definition of Straight life insurance. After death however the payments cease and the policyholder does not name a beneficiary. IRMI offers the most exhaustive resource of definitions and other help to insurance professionals found anywhere.

Determine the cost of the asset. Book value residual value X depreciation rate. Straight line depreciation method charges cost.

If you receive dividends on your straight life policy they only become taxable when the amount of dividends received is higher than the premiums paid into the life insurance policy. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest goes to the cash. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

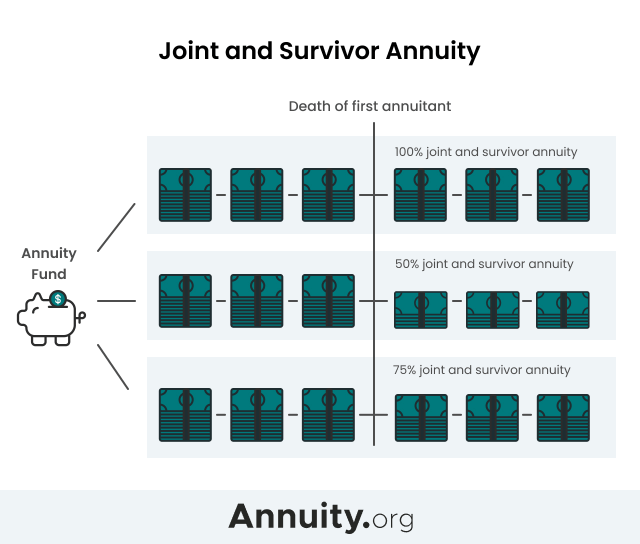

Joint And Survivor Annuity The Benefits And Disadvantages

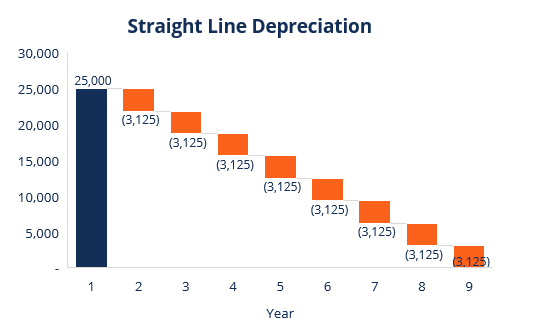

Depreciation Methods 4 Types Of Depreciation You Must Know

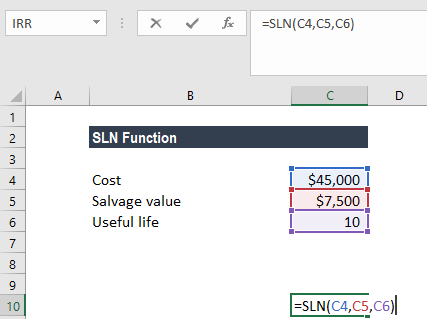

Sln Function Excel Formula For Straight Line Depreciation Examples

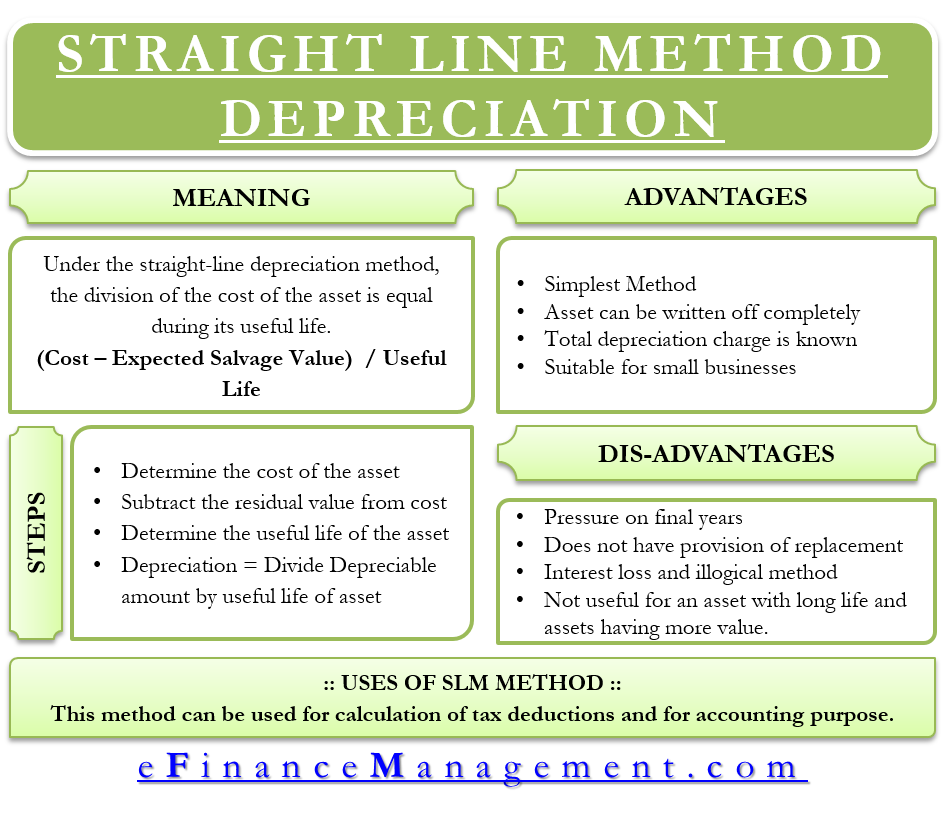

Straight Line Depreciation Efinancemanagement

Written Down Value Method Of Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods 4 Types Of Depreciation You Must Know

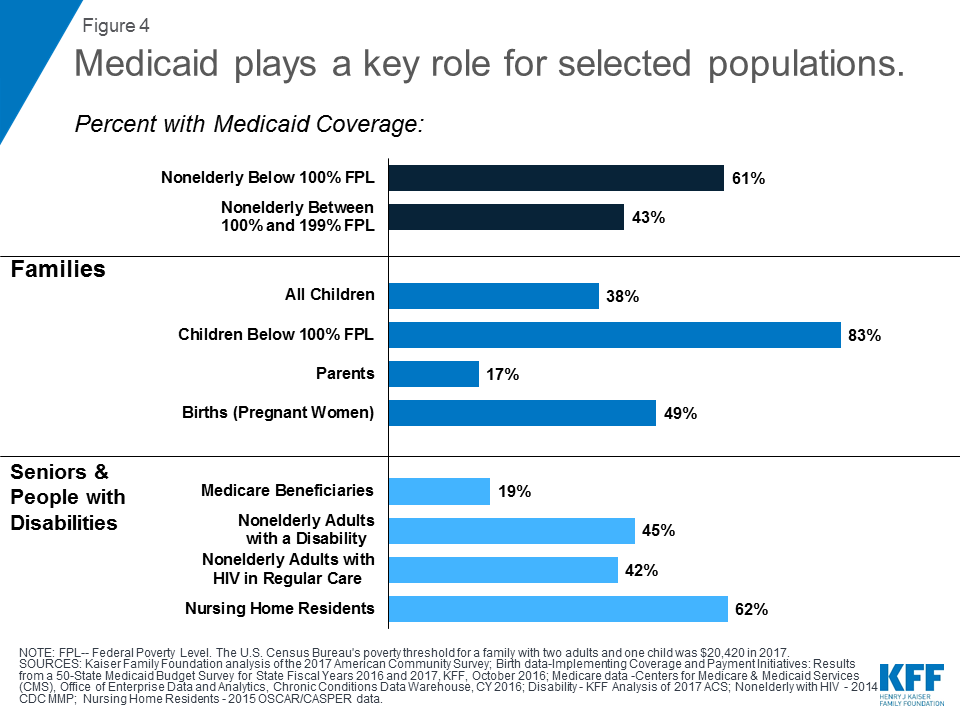

10 Things To Know About Medicaid Setting The Facts Straight Kff

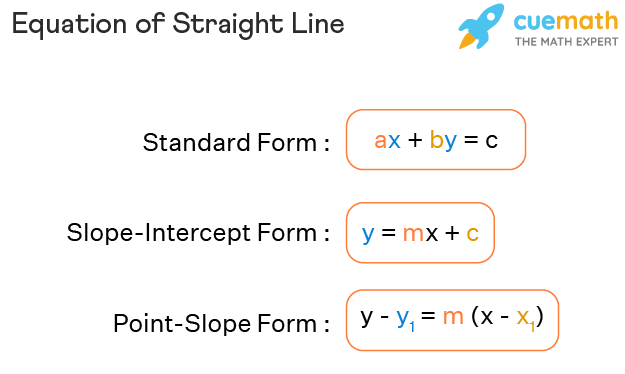

Equation Of Straight Line Forms Formula Examples What Is Equation Of Line

Point Slope Form Straight Lines Class 11 Maths Geeksforgeeks

Salvage Value Formula Calculator Excel Template

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Examples With Excel Template

Point Slope Form Straight Lines Class 11 Maths Geeksforgeeks

Accumulated Depreciation Formula Calculator With Excel Template

Straight Line Depreciation Template Download Free Excel Template

Straight Line Depreciation Formula Guide To Calculate Depreciation

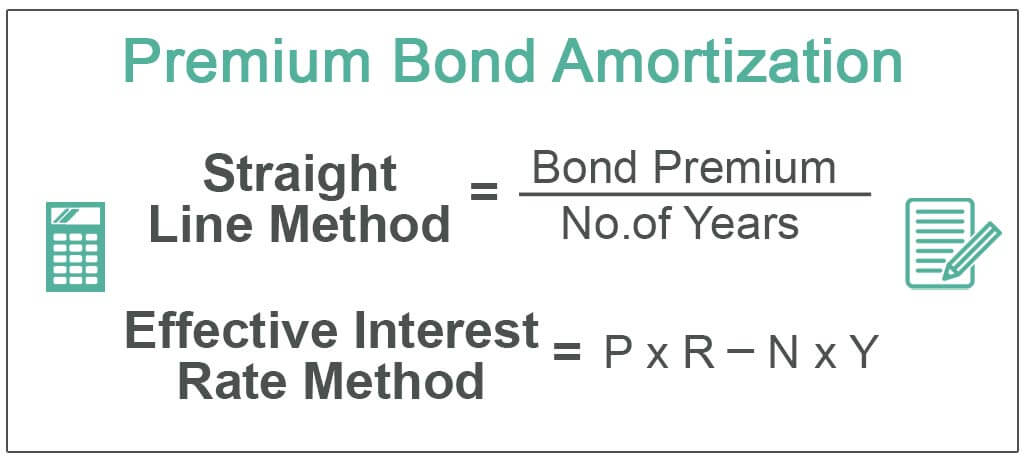

Amortization Of Bond Premium Step By Step Calculation With Examples